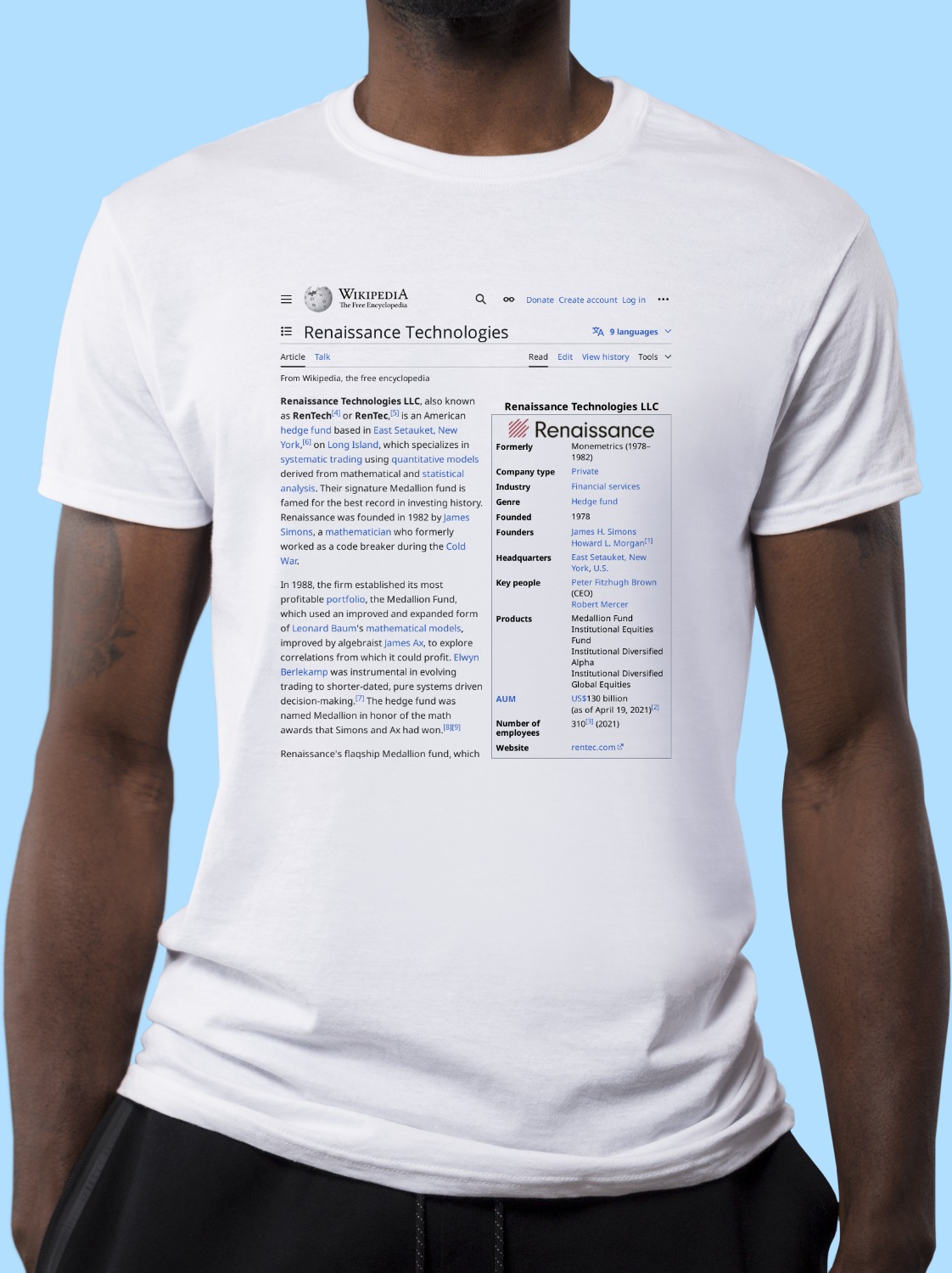

Renaissance Technologies Shirt

A classic cotton tee emblazoned with the Wikipedia article on Renaissance Technologies ↗.

cotton tee emblazoned with the Wikipedia article on Renaissance Technologies ↗.- Preshrunk jersey knit

- Seamless double-needle 2.2 cm collar

- Taped neck and shoulders

- Tear away label

- Double-needle sleeve and bottom hems

- Quarter-turned to eliminate centre crease

Renaissance Technologies LLC, also known as RenTech or RenTec, is an American hedge fund based in East Setauket, New York, on Long Island, which specializes in systematic trading using quantitative models derived from mathematical and statistical analysis. Their signature Medallion fund is famed for the best record in investing history. Renaissance was founded in 1982 by James Simons, a mathematician who formerly worked as a code breaker during the Cold War.

In 1988, the firm established its most profitable portfolio, the Medallion Fund, which used an improved and expanded form of Leonard Baum's mathematical models, improved by algebraist James Ax, to explore correlations from which it could profit. Elwyn Berlekamp was instrumental in evolving trading to shorter-dated, pure systems driven decision-making. The hedge fund was named Medallion in honor of the math awards that Simons and Ax had won.

Renaissance's flagship Medallion fund, which is run mostly for fund employees, is famous for the best track record on Wall Street, returning more than 66 percent annualized before fees and 39 percent after fees over a 30-year span from 1988 to 2018. Renaissance offers two portfolios to outside investors—Renaissance Institutional Equities Fund (RIEF) and Renaissance Institutional Diversified Alpha (RIDA).

Because of the success of Renaissance in general and Medallion in particular, Simons has been described as the "best money manager on earth".

Simons ran Renaissance until his retirement in late 2009. He continued to play a role at the firm as non-executive chairman, which he stepped down from in 2021, and remained invested in its funds, particularly the Medallion fund until his death in 2024. The company is now run by Peter Brown (after Robert Mercer resigned). Both of them were computer scientists specializing in computational linguistics who joined Renaissance in 1993 from IBM Research. The fund has $165 billion in discretionary assets under management (including leverage) as of April 2021.

About Wikishirt

Wikishirt is a retail experiment that lets you buy a shirt with any Wikipedia Article printed on it. There are over 5 million Wikipedia articles, so we have over 5 million shirts.Check out our homepage for random featured shirts and more!